New car loan calculator full#

When a car is purchased via loan and not cash, full coverage insurance is often mandatory.

New car loan calculator driver#

New car loan calculator registration#

Title and Registration Fees-This is the fee collected by states for vehicle title and registration.Document Fees-This is a fee collected by the dealer for processing documents like title and registration.Alaska, Delaware, Montana, New Hampshire, and Oregon are the five states that don't charge sales tax. It is possible to finance the cost of sales tax with the price of the car, depending on the state the car was purchased in. The following is a list of common fees associated with car purchases in the U.S. However, car buyers with low credit scores might be forced into paying fees upfront. FeesĪ car purchase comes with costs other than the purchase price, the majority of which are fees that can normally be rolled into the financing of the auto loan or paid upfront. While some used car dealers do offer cash rebates, this is rare due to the difficulty involved in determining the true value of the vehicle. Generally, rebates are only offered for new cars. They are Alaska, Arizona, Delaware, Iowa, Kansas, Kentucky, Louisiana, Massachusetts, Minnesota, Missouri, Montana, Nebraska, New Hampshire, Oklahoma, Oregon, Pennsylvania, Rhode Island, Texas, Utah, Vermont, and Wyoming. Luckily, a good portion of states do not do this and don't tax cash rebates. For example, purchasing a vehicle at $50,000 with a cash rebate of $2,000 will have sales tax calculated based on the original price of $50,000, not $48,000. Depending on the state, the rebate may or may not be taxed accordingly. Vehicle RebatesĬar manufacturers may offer vehicle rebates to further incentivize buyers.

It is not rare to get low interest rates like 0%, 0.9%, 1.9%, or 2.9% from car manufacturers. Consumers in the market for a new car should start their search for financing with car manufacturers. Often, to promote auto sales, car manufacturers offer good financing deals via dealers. With dealer financing, the potential car buyer has fewer choices when it comes to interest rate shopping, though it's there for convenience for anyone who doesn't want to spend time shopping or cannot get an auto loan through direct lending.

Getting pre-approved doesn't tie car buyers down to any one dealership, and their propensity to simply walk away is much higher. The contract is retained by the dealer but is often sold to a bank, or other financial institution called an assignee that ultimately services the loan.ĭirect lending provides more leverage for buyers to walk into a car dealer with most of the financing done on their terms, as it places further stress on the car dealer to compete with a better rate. Auto loans via dealers are usually serviced by captive lenders that are often associated with each car make. Dealership financing is somewhat similar except that the auto loan, and thus paperwork, is initiated and completed through the dealership instead. Once a contract has been entered with a car dealer to buy a vehicle, the loan is used from the direct lender to pay for the new car. The former comes in the form of a typical loan originating from a bank, credit union, or financial institution. Generally, there are two main financing options available when it comes to auto loans: direct lending or dealership financing. Money borrowed from a lender that isn't paid back can result in the car being legally repossessed.

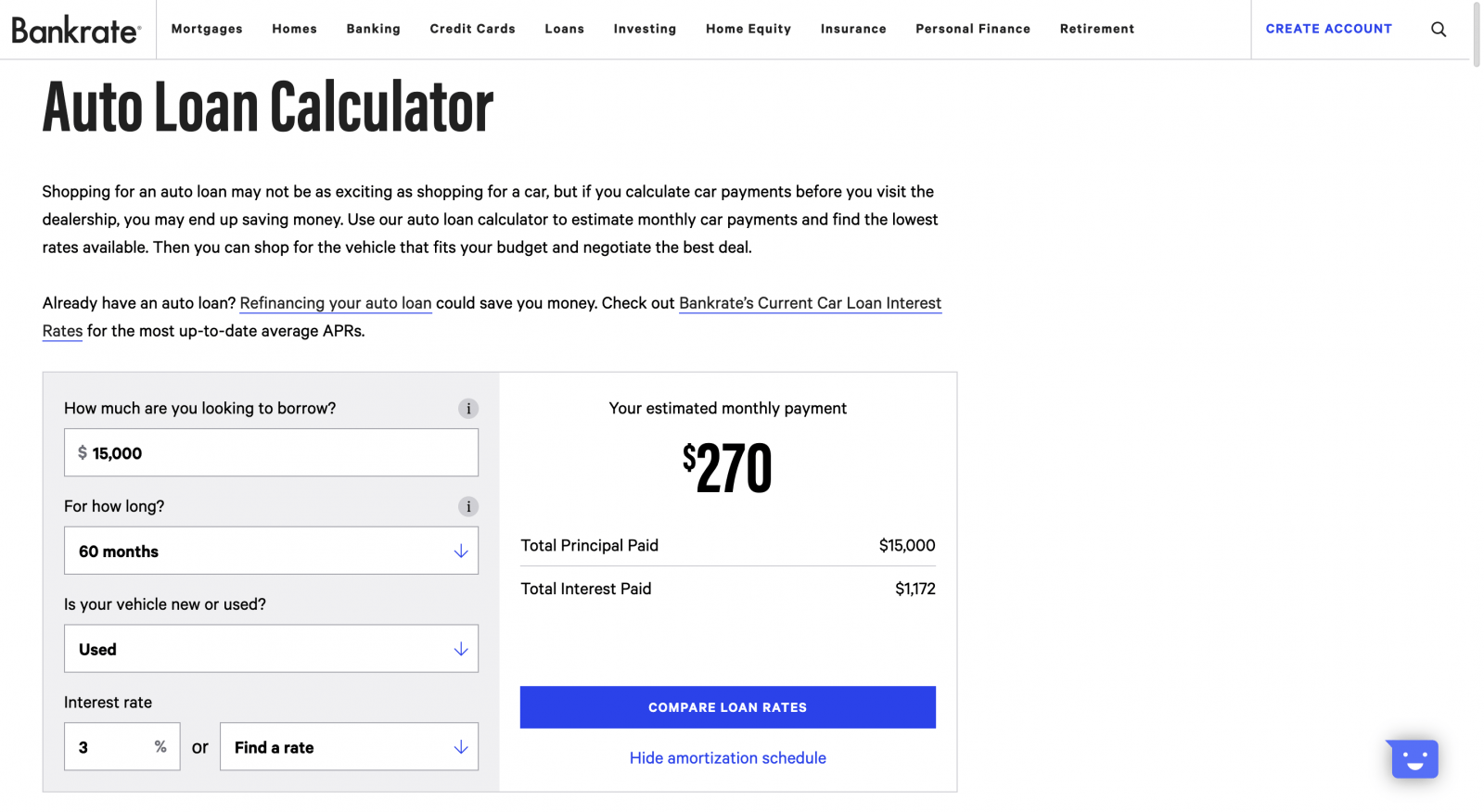

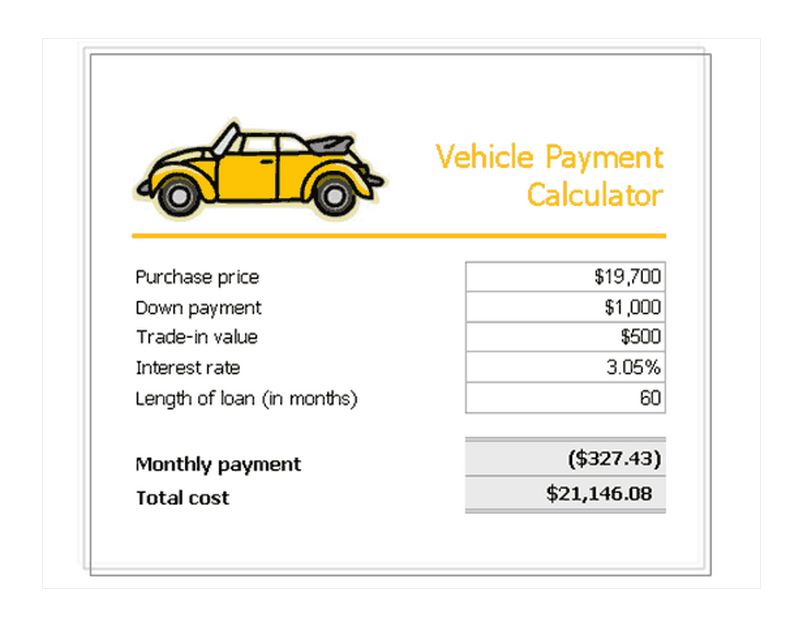

Each month, repayment of principal and interest must be made from borrowers to auto loan lenders. They work as any generic, secured loan from a financial institution does with a typical term of 36, 60, 72, or 84 months in the U.S. Most people turn to auto loans during a vehicle purchase. If only the monthly payment for any auto loan is given, use the Monthly Payments tab (reverse auto loan) to calculate the actual vehicle purchase price and other auto loan information. may still use the calculator, but please adjust accordingly. The Auto Loan Calculator is mainly intended for car purchases within the U.S. Related Cash Back or Low Interest Calculator | Auto Lease Calculator

0 kommentar(er)

0 kommentar(er)